-By Neha Basudkar Ghate

The Indian automotive industry is poised for a significant transformation with the launch of the Next-Generation GST reforms set to take effect from September 22, 2025. These sweeping tax reforms, approved by the GST Council, aim to simplify the taxation structure, reduce the tax burden on mass-market vehicles, and promote affordability and sustainability across the sector. By restructuring GST slabs and providing targeted relief to small and medium vehicles, electric vehicles, and auto components, the reforms are expected to boost domestic sales, enhance manufacturing competitiveness, and accelerate India’s transition toward green mobility. This pivotal move signals a new era for automotive consumers and manufacturers alike, fostering growth aligned with India’s economic vision for the future.

The GST Council’s 56th meeting, held on 3 September 2025, marked a landmark development for the Indian automotive sector. The Council approved sweeping Next-Gen GST reforms—a two-tier rate structure aimed at making the tax system simpler and more growth-friendly. Most notably for auto, a new split into 5%, 18%, and a special 40% slab for luxury and sin-goods was introduced, ending multiple rate confusion

These revisions, effective 22 September 2025 (coinciding with Navaratri), are expected to reshape vehicle pricing, boost affordability for entry-level buyers, and streamline compliance.

GST 2.0 to Strengthen Growth and Reduce Tax Burden

The Goods and Services Tax (GST), introduced on July 1, 2017, remains India’s most significant indirect tax reform since Independence. By merging multiple central and state levies into a unified system, GST created a common national market, reduced cascading taxes, simplified compliance, and enhanced transparency. Over the past eight years, it has evolved through rate rationalisation and digitalisation, becoming the backbone of India’s indirect tax framework.

In its 56th meeting, chaired by Union Finance Minister Smt. Nirmala Sitharaman, the GST Council approved Next-Gen GST reforms designed to improve the lives of citizens and ensure ease of doing business for all, including small traders and entrepreneurs. Prime Minister Narendra Modi, in his Independence Day address, had assured that these reforms would bring down the tax burden for the common man, calling it a “Diwali gift.” He emphasised that the changes would directly benefit farmers, MSMEs, women, youth, and middle-class families, while also bolstering India’s long-term economic growth.

The Council has recommended a comprehensive reform package anchored on a simplified two-slab structure of 5% and 18%. Sweeping rate reductions will be applied across multiple sectors, particularly those central to the common man, labour-intensive industries, agriculture, health, and other key drivers of the economy. These measures were adopted through consensus among all Council members to make GST simpler, fairer, and more growth-oriented.

The new rates and exemptions will take effect from September 22, 2025, delivering timely relief to households, farmers, and businesses. The only exception will be specified goods such as cigarettes, chewing tobacco (including zarda), unmanufactured tobacco, and beedis. For these, the current GST and compensation cess rates will continue until the full repayment of loan and interest liabilities linked to the compensation cess, after which the revised rates will be notified.

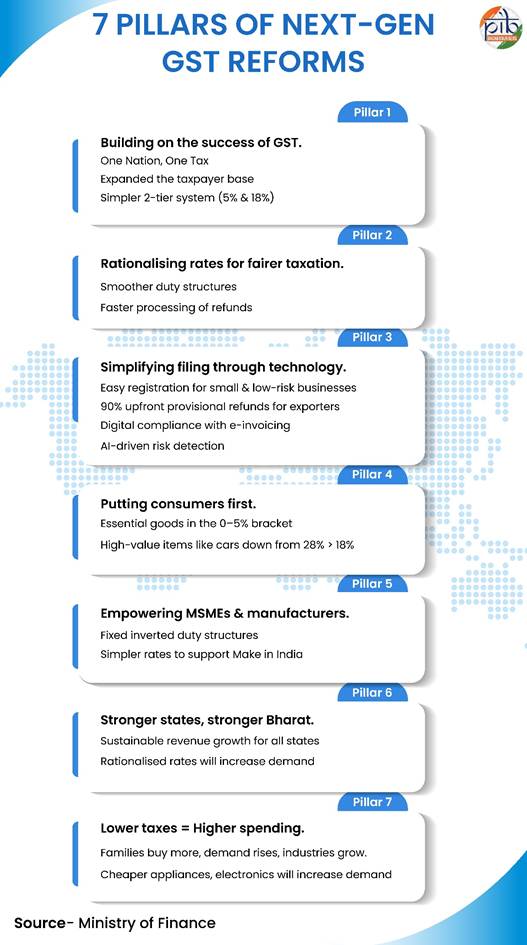

7 Pillars of Next-Gen GST Reforms

The Goods and Services Tax (GST) reforms of 2025 introduce a major simplification and restructuring of taxes in the Indian automotive industry. The reforms mainly focus on rationalizing tax rates, clearing classification ambiguities, and fostering growth in the automotive sector by making vehicles more affordable and compliance easier.

The new GST framework for the automotive industry moves away from the previous complex multi-rate system (with slabs at 12%, 18%, 28% plus various compensatory cesses) to a simplified three-tier tax structure comprising 5%, 18%, and 40%. This restructuring makes taxation more transparent and fair and reduces operational costs for manufacturers, dealers, and consumers alike.

Key GST Rate Changes for Automobiles

- Reduced GST for Small Cars and Two-Wheelers: Small petrol, LPG, and CNG cars with engine capacities below 1,200 cc and diesel cars up to 1,500 cc — provided they are under 4,000 mm in length — will now attract an 18% GST instead of the earlier 28%. This benefits popular models such as Maruti Swift, WagonR, Hyundai i20, Tata Altroz, Renault Kwid, and Hyundai Exter. Similarly, two-wheelers with engines up to 350 cc, including widely sold motorcycles like Hero Splendor, Honda Shine, TVS Apache, Bajaj Pulsar, and Royal Enfield Classic, will also see a reduction from 28% to 18%. This cut enhances affordability for first-time buyers and middle-income families.

- Commercial Vehicles: GST on three-wheelers, buses, trucks, and ambulances is cut from 28% to 18%, reducing operating costs and encouraging growth in the commercial vehicle segment.

- Electric Vehicles (EVs): The 5% GST rate on electric vehicles remains unchanged, underscoring government support for clean mobility and environmental sustainability. This concessional rate helps make EVs economically appealing and prospects for rapid adoption stronger.

- Luxury and Larger Vehicles: Premium midsize and large vehicles exceeding 1,200 cc petrol or 1,500 cc diesel capacity or longer than 4,000 mm will now incur a flat 40% GST. This category includes popular SUVs such as the Hyundai Creta, Kia Seltos, Tata Harrier, Mahindra XUV700, and Toyota Fortuner. While this is a rise from the base 28% GST, it replaces an earlier combined tax burden (GST plus compensation cess) of nearly 50%, effectively lowering the overall taxation complexity and rate for luxury vehicle buyers. Motorcycles above 350 cc, including models like Royal Enfield Himalayan 450 and KTM Duke 390, are also placed under this 40% GST bracket.

- Auto Parts: The GST on all automobile components has been standardized to 18% from earlier varying rates up to 28%, which will streamline compliance, reduce costs in manufacturing and supply chains, and potentially lower final vehicle prices.

Additional Benefits and Simplifications

- The GST reforms eliminate the compensation cess on automobiles, simplifying the tax structure and making overall tax incidence clearer and easier to manage for manufacturers and dealers.

- Registration, return filing, and refund processes have been simplified, with faster processing and reduced compliance costs, thereby easing the operational burden, especially for MSMEs and startups in the auto sector.

- More accurate and clearer classification of vehicles and auto parts will reduce disputes and improve adherence to tax rules, fostering a smoother path for growth in automotive manufacturing and exports.

Market Impact and Industry Outlook

- The restructuring and tax cuts on small and entry-level vehicles are expected to give a strong boost to domestic sales, especially aligned with the festive season demand surge.

- The electric vehicle segment, supported by a consistent low slab, stands to accelerate adoption as GST rationalization aligns with India’s green mobility goals.

- Commercial vehicles will become more cost-competitive, which could invigorate the transportation and logistics sectors.

- Stock markets responded positively to the reforms announcement, with auto sector stocks gaining significantly — key players like Mahindra & Mahindra, Eicher Motors, Maruti Suzuki, Hyundai Motor India, Hero MotoCorp, and TVS Motor experienced notable share price increases, signaling investor confidence.

Summary of GST Revisions for Automotive Sector:

- Small cars, two-wheelers ≤350cc: GST reduced from 28% to 18%

- Buses, trucks, three-wheelers: GST reduced from 28% to 18%

- Auto parts: GST standardized at 18%

- Electric vehicles: GST remains at 5%

- Mid-size and large cars, motorcycles >350cc: GST set at 40%, simplifying previous higher combined tax rates with the removal of additional cess

These reforms will reduce the incidence of cascading taxes, improve pricing transparency, and lower the cost of ownership for smaller vehicles while balancing revenue through higher taxation on luxury and sin goods. The overall effect is anticipated to stimulate the automotive market, encourage manufacturing growth, and support a cleaner, greener mobility transition for India.

This comprehensive rationalization of GST will create a more predictable, fair, and growth-oriented taxation environment for the automotive industry, enhancing consumer affordability and business ease across the sector.

How has the industry reacted?

Mr. Shailesh Chandra, President, SIAM

Automobile Industry welcomes the Government’s decision to reduce the GST on vehicles to 18% and 40%, from earlier rates of 28% to 31% and 43% to 50%, respectively, especially in this festive season. This timely move is set to bring renewed cheer to consumers and inject fresh momentum into the Indian Automotive sector. Making vehicles more affordable, particularly in the entry-level segment; these announcements will significantly benefit first-time buyers and middle-income families, enabling broader access to personal mobility. We also thank the Government of India for continuing with GST rate of 5% on Electric Vehicles, which will help sustain the ongoing momentum towards sustainable mobility.

Furthermore, the resolution of classification interpretations and the correction of the inverted duty structure will greatly streamline business processes across the automotive industry, supporting ease of doing business. We are confident that the Government will also soon notify suitable mechanisms for the utilisation of compensation cess on unsold vehicles, ensuring a smooth and effective transition.

Mr. Parmod Sagar Chairman, Managing Director and CEO, RHI Magnesita India Ltd.

India’s economy has remained resilient amid global challenges, recording real GDP growth of 7.8% in Q1 FY26. This strength was also recently highlighted by the Hon’ble Prime Minister. The GST Council’s decision to reduce the tax rate, particularly on cement, will further support the economy’s consistent growth momentum. The new GST rate for cement is a timely and welcome step aimed at fueling India’s economy through the infrastructure sector. The refractory industry, which is integral to cement manufacturing, is also expected to benefit, as it has long faced challenges due to high input costs of raw materials.

Mr. Rajesh Bhatia, Group President (Finance & Accounts) and CFO, UFlex Limited

We welcome the government’s bold and progressive GST reforms, which will certainly boost domestic consumption and propel economic growth. Consumption and packaging are directly correlated, and we expect a significant uptick in demand for packaging. With affordability driving growth, we anticipate a surge in smaller and more convenient pack sizes, along with a stronger push for sustainable and recyclable packaging solutions. We see this as an opportunity to partner more effectively with FMCG brands by delivering innovative, high-quality, and eco-friendly packaging that reaches millions of households across India.

Dr. Anish Shah, Group CEO & MD, Mahindra Group

The next-generation GST reforms announced today mark a defining moment in India’s journey towards building a simpler, fairer, and more inclusive tax system. By moving to a streamlined two-rate structure and focusing on essentials that touch the lives of every citizen- from food, health, and insurance to agriculture and small businesses -the Government has reaffirmed its commitment to Ease of Living and Ease of Doing Business. The rationalisation measures will not only provide immediate relief to households but also strengthen key sectors such as automobiles, agriculture, healthcare, renewable energy, and MSMEs – all of which are vital to job creation and sustainable growth. The correction of long-pending inverted duty structures in critical industries is welcome.

At Mahindra, we view these reforms as transformative. They simplify compliance, expand affordability, and energise consumption, while enabling industry to invest with greater confidence. This bold step is in line with the vision articulated by the Hon’ble Prime Minister of building a citizen-centric, future-ready Bharat. It strengthens India’s economic foundations and will help drive the next phase of equitable and inclusive growth- journey towards Viksit Bharat @2047.

Mr. Rajesh Jejurikar, ED & CEO -Auto and Farm Sector, M&M

We applaud the Government for this landmark GST rationalisation, which will have a far-reaching positive impact across the automotive and farming sectors . The move makes tractors and farm machinery more affordable for farmers, reduces costs for commercial vehicles and improves accessibility for personal mobility through rationalisation of rates across all SUVs. Together, these measures are expected to stimulate demand, and drive inclusive growth across the entire ecosystem.

We also appreciate the continuation of the 5% GST rate on EVs, which is a critical enabler of India’s clean mobility vision. This measure will further accelerate the adoption of electric vehicles and reinforce India’s leadership in sustainable, green transportation.

Mr. Aasif Malbari, Chief Financial Officer, Godrej Consumer Products Ltd

We welcome the government’s initiative of lowering taxes to boost consumption. This is a positive trigger for demand and strong driver of volume growth. This move will ultimately contribute to overall economic momentum. GCPL has leading soap brands such as Cinthol and Godrej No.1 and hence welcomes this move. We are fully committed to ensuring that the GST rates reduction benefits are passed on to consumers.” – Aasif Malbari, Chief Financial Officer, Godrej Consumer Products Ltd.

Mr. Ashok P. Hinduja, Chairman, Hinduja Group of Companies (India)

The GST Rate cuts announced across the board augur well for the Indian Economy as they will support India’s macroeconomic stability by spurring demand at the very grassroots level. This move was a much-needed consumption booster to cushion the global economic headwinds resulting from the lopsided tariff regimes being pushed by the US. It will have a cascading positive effect on several adjacent sectors, both upstream and downstream. To achieve the vision of Viksit Bharat @ 2047, the nation needs several social security nets for citizens. Steps like reducing GST to NIL on Life and Health Insurances will prove to be revolutionary in this regard. I hope the GST Process Compliances also stand simplified.

COMMENTS