-Neha Basudkar Ghate

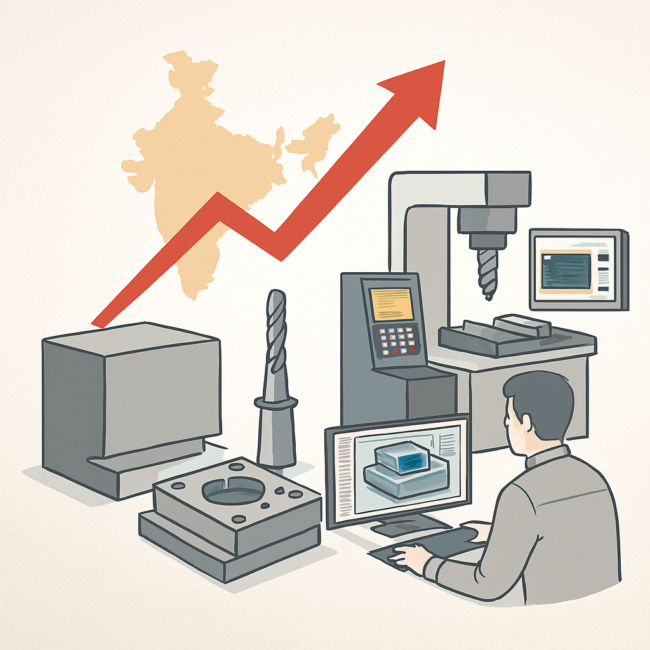

This article explores the outlook for the Indian dies and mould market 2026 and the India tooling industry market, highlighting strong growth forecasts, technological innovations, and sustainability trends. Drawing on insights from industry leaders, it examines how integration, automation, and global-standard practices are reshaping India’s manufacturing landscape. While opportunities abound in automotive, aerospace, and electronics, challenges such as skill shortages and the need for advanced training remain. The story underscores India’s transition from cost competitiveness to capability-driven manufacturing, positioning its tooling ecosystem as a strategic partner in global supply chains.

The Indian dies and mould market 2026 and the India tooling industry market are entering a decisive phase. With India’s manufacturing sector expanding across automotive, aerospace, electronics, and medical devices, the demand for precision tooling and moulding solutions is accelerating. Industry leaders agree that the next decade will be defined by integration, automation, and sustainability but they differ on how quickly India can overcome structural challenges.

Market Outlook: Dies & Moulds

Technavio projects the Indian dies and mould market to grow by USD 2.84 billion between 2024 and 2029, at a CAGR of 11.4%. Growth is being driven by aluminium metal injection moulding, simulation technologies, and advanced materials such as carbon and high-speed steel.

Amol Mane, Director of Sales and Marketing, Cimatron emphasises that competitiveness now depends on integration, he said “Machine tools, cutting tools, and CAD/CAM software must work together. This move toward collaboration and integration is defining the next phase of growth for India’s tooling ecosystem.”

Paul Weaver, Director of Sales & Marketing, Renishaw India echoes this sentiment, but from a metrology perspective, he emphasised that, “The die and mould industry, which relies heavily on precision measurement, is a significant part of this market. As automated facilities take over automotive manufacturing, the need for highly dependable and high-quality procedures will drive demand.”

Together, their views highlight a common thread: precision and integration are non-negotiable for the Indian dies and mould market 2026.

Market Outlook: Tooling Industry

The India tooling industry market reached USD 20.1 billion in 2025 and is expected to grow to USD 37.7 billion by 2034, at a CAGR of 7.2%. This growth is fuelled by advanced tooling solutions, shorter delivery cycles, and eco-friendly processes.

Here, Mane and Weaver converge again. Mane points to OEMs increasingly preferring Indian suppliers if they meet global benchmarks, while Weaver notes that “India is shifting from low-cost to high-precision manufacturing, prompting global players to lower prices and invest in localised support.” Both perspectives reinforce the idea that India’s tooling industry is no longer defined solely by cost competitiveness, but by capability and reliability.

Diverging Perspectives: Skills and Sustainability

Where industry voices diverge is on the question of labour and skills. Sandeep Jain, Director, Sandeep EdgeTech warns, that, “The tooling ecosystem suffers from a shortage of skilled labour and limited access to next-generation technologies. Collaborative efforts between OEMs, industry leaders, and policy-makers are crucial.”

Mane acknowledges this challenge but frames integration and automation as the solution, while Jain insists that without targeted training in die design, CNC operation, and thermal processing, growth will plateau. His call for mentorship and policy support contrasts with the more technology-driven optimism of Mane and Weaver, creating a healthy tension in the narrative: India’s tooling future depends on both digitalisation and human capital.

Future Pathways

By 2026, the Indian dies and mould market will be defined by end-to-end capability from design and simulation to machining and finishing. The India tooling industry market will evolve through:

- Integration of digital technologies for precision and efficiency.

- Collaborative ecosystems linking OEMs, suppliers, and technology providers.

- Skill development and sustainability as competitive differentiators.

As Weaver notes, global manufacturers are already recalibrating their strategies to include India as a reliable partner. Jain’s cautionary perspective ensures that the industry does not overlook the human element. Together, these voices paint a picture of an ecosystem at an inflection point: poised for growth, but dependent on how well India balances technology, skills, and sustainability.

Conclusion

The Indian dies and mould market 2026 and the India tooling industry market are converging toward a future defined by precision, integration, and sustainability. Industry voices agree that automation, digitalisation, and advanced materials will be the engines of growth, while skill development remains the critical bottleneck. As Mane and Weaver highlight, India is steadily shifting from cost-driven manufacturing to capability-driven partnerships, gaining recognition as a reliable global player. Yet, as Jain cautions, without targeted investment in human capital, the sector’s full potential may remain unrealised. Balancing technology with talent will determine whether India’s tooling ecosystem achieves its ambitious growth trajectory and secures its place on the global stage.

COMMENTS